Last Updated on November 17, 2021 by uptransport

This step-by-step guide will help you in paying Online Road Tax Payment for Vehicles in Uttar Pradesh. Read this article till the end to know about the complete process.

Are you looking for some guidance on How to Pay your Vehicle Tax? Or Do you want to re-verify Road Tax Payment?

Well, we got you there!

Let’s today learn What Road Tax is and How to Pay it easily!

We all know how important it is to pay the vehicle tax in Uttar Pradesh, this article will guide you with online road tax payment and how to pay it.

Table of Contents

What is Road Tax?

Road tax is a Tax on Vehicles imposed by both the State and Central Governments of India. Every vehicle/automobile owner has to pay road tax to the concerned Regional Transport Office (RTO). Both commercial and private vehicle owners have to pay road tax which is based on certain factors like engine capacity, vehicle type, seating capacity, cost of the vehicle, the weight of the vehicle, etc.

Road tax also includes toll tax, which is collected by vehicles traveling on a particular stretch of the concerned state/national highway.

Normally, the Road Tax is levied by the State Governments since they have to do the task of construction and maintenance of roads. So, you would have to pay the road tax levied by the State in which you buy your vehicle.

Two Ways to Pay Road Tax Payment Online in Uttar Pradesh

Road tax in any state of India can be paid in two ways – offline and online. We will see the steps involved for both these ways:

- Road tax offline payment –To pay your road tax offline, you need to visit the RTO of your State and fill the relevant form. Submit the form along with the payment of the road tax and the tax would be paid.

- Road Tax Online Payment – With the help of Parivahan Website, you can easily pay the road tax online.

How is road tax calculated in Uttar Pradesh?

Calculation of Tax in various states of India is done by considering certain parameters.

Uttar Pradesh road tax is calculated on the basis of – type of vehicles ( two-wheeler or a four-wheeler ) and the purpose for which is to be used. Commercial vehicles have to pay different road tax as compared to personal vehicles.

As per the laws of the state govt of UP, all vehicles will pay UP road tax for the first time during registration.

Online Road Tax Payment for Vehicles in Uttar Pradesh

Nowadays, paying vehicle tax online is quite an easy thing.

By parivahan website, you can pay your vehicle tax in some minutes and save yourself from the long queues at RTO offices !

Step-By-Step Guide to Pay Vehicle Tax Online in UP –

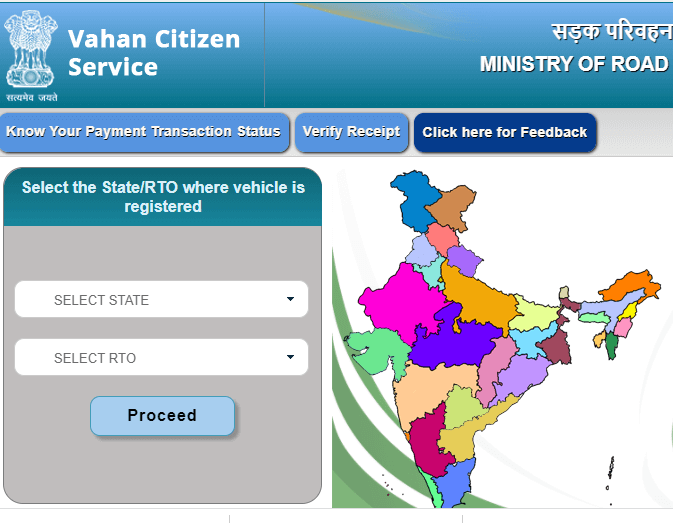

- Go and visit the Vahan Parivahan Website click here.

- Now you need to select Uttar Pradesh as your state and then choose Uttar Pradesh RTO and Proceed.

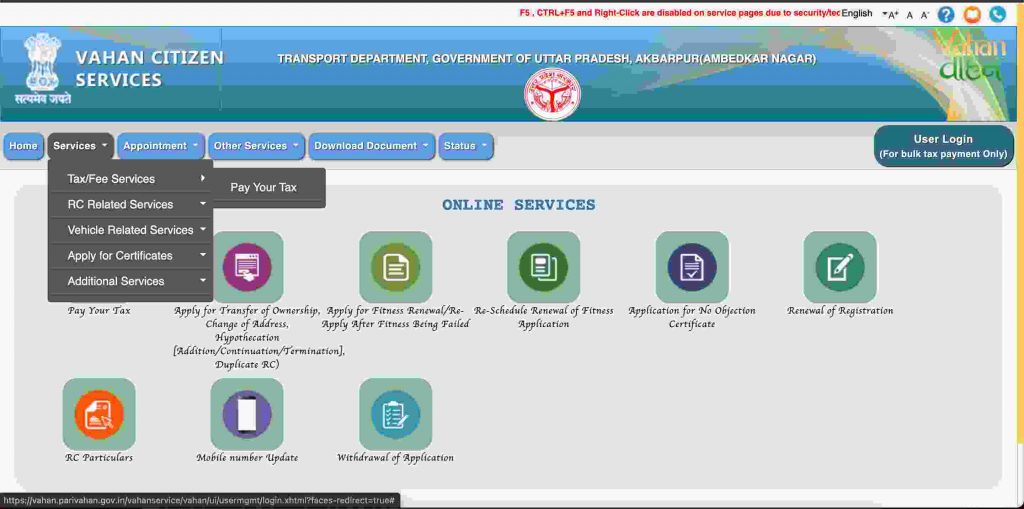

- Inside the Services section, Go for Tax/Fee Services.

- Click on Pay Your Tax.

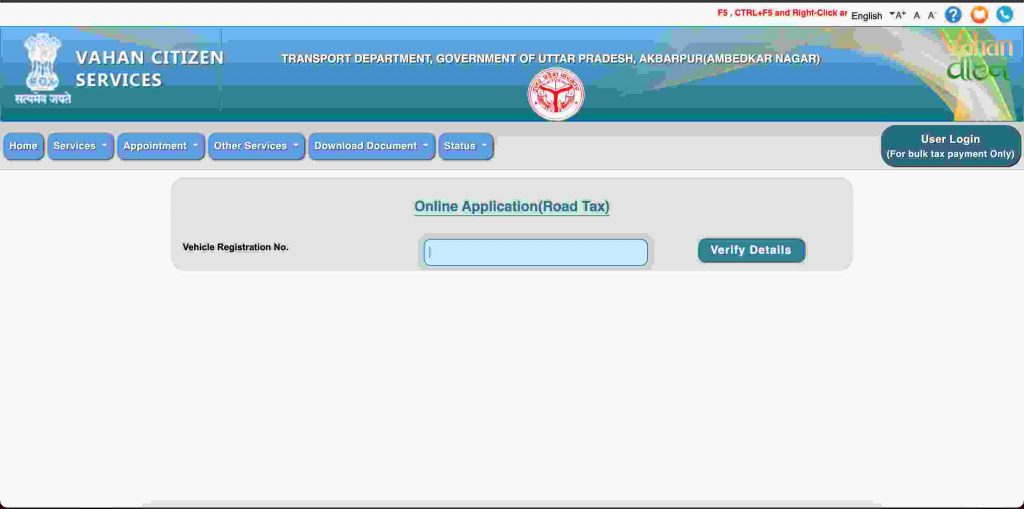

- Enter your Vehicle Registration Number.

- Your pending vehicle tax will be showing.

- Pay Your pending vehicle tax using online services like a net banking or debit card.

- You have successfully paid your Vehicle Tax!

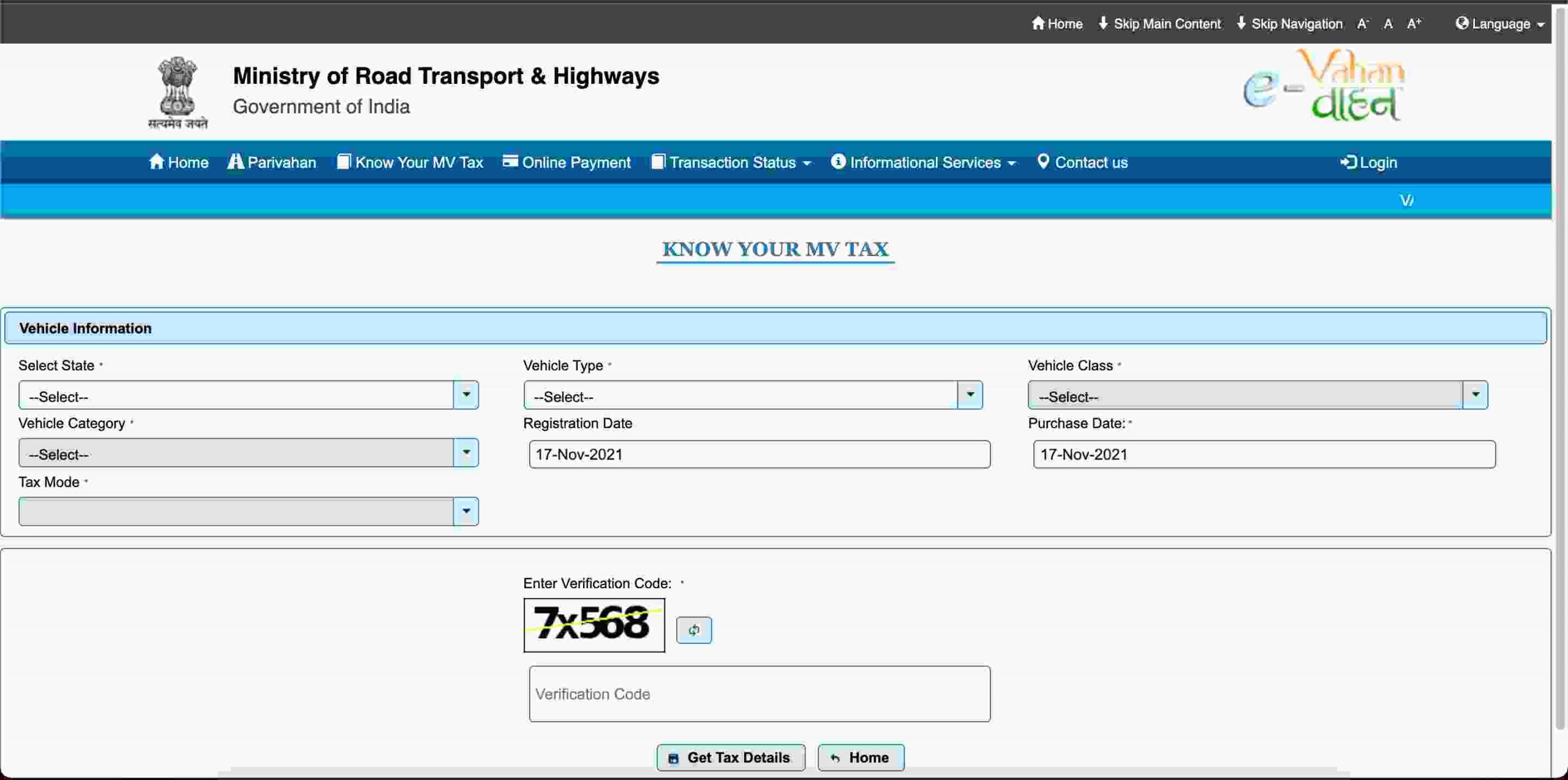

How To Check Vehicle Tax Amount in Uttar Pradesh

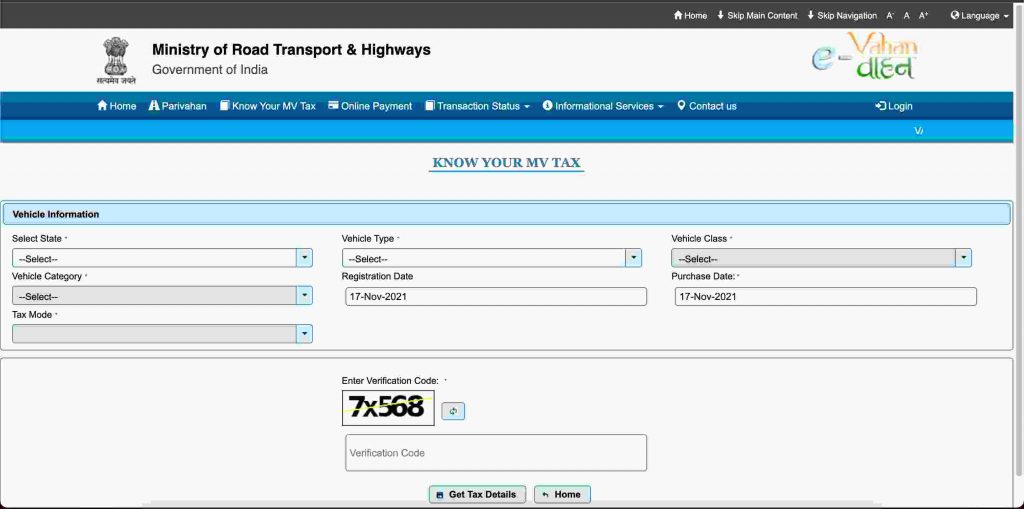

- Go and check the Vahan website click here

- Click on the “Know MV Tax” option.

- Now enter all the required details.

- Fill In the captcha code.

- Click on the get details button.

- The remaining tax will be shown on your screen.

Related Articles:

- Bharat BH Series Vehicle Registration in UP

- Check Vehicle Ownership Transfer / RC Transfer Status in Uttar Pradesh

- Transferring Ownership of Vehicle In Uttar Pradesh

Conclusion

The Indian government charges a tax on the purchase of a new vehicle mainly for the maintenance of the Indian roadways. The Tax you pay includes all kinds of minor taxes levied by the Govt for the resources used by citizens.

Vehicle Tax can be paid easily now with the help of online services provided by Parivahan Portal. The online payment method makes the work less time-consuming and more secure. The parivahan portal is useful for the citizens of India, in many other ways also. All kinds of work related to transportation, from issuance of Driving License, to the payment of Vehicle Tax can be done using the portal.

We hope you successfully got to know all about the road tax, its imposition rules and payment methods through this article. Remember, to not share your credentials with anyone, as it may lead to fraud.

We hope this article helped you in learning about the Road Tax and various ways to pay it in the state of Uttar Pradesh.

Stay tuned with us for more such information !